rsu tax rate us

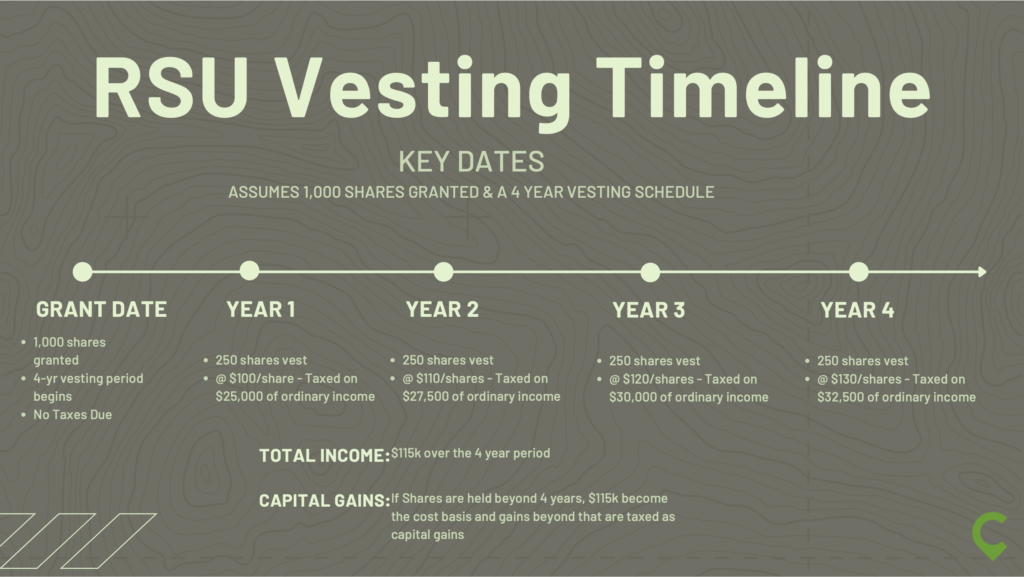

How your stock grant is delivered to you and whether or not it is vested. Lets say you are granted 200 RSUs on 3112 14From your OP these will vest become yours in equal instalments over the next four anniversary dates -so 50 shares on 3112 15then 50 shares on 3112 16 etc.

A Tech Employee S Guide To Rsus Cordant Wealth Partners

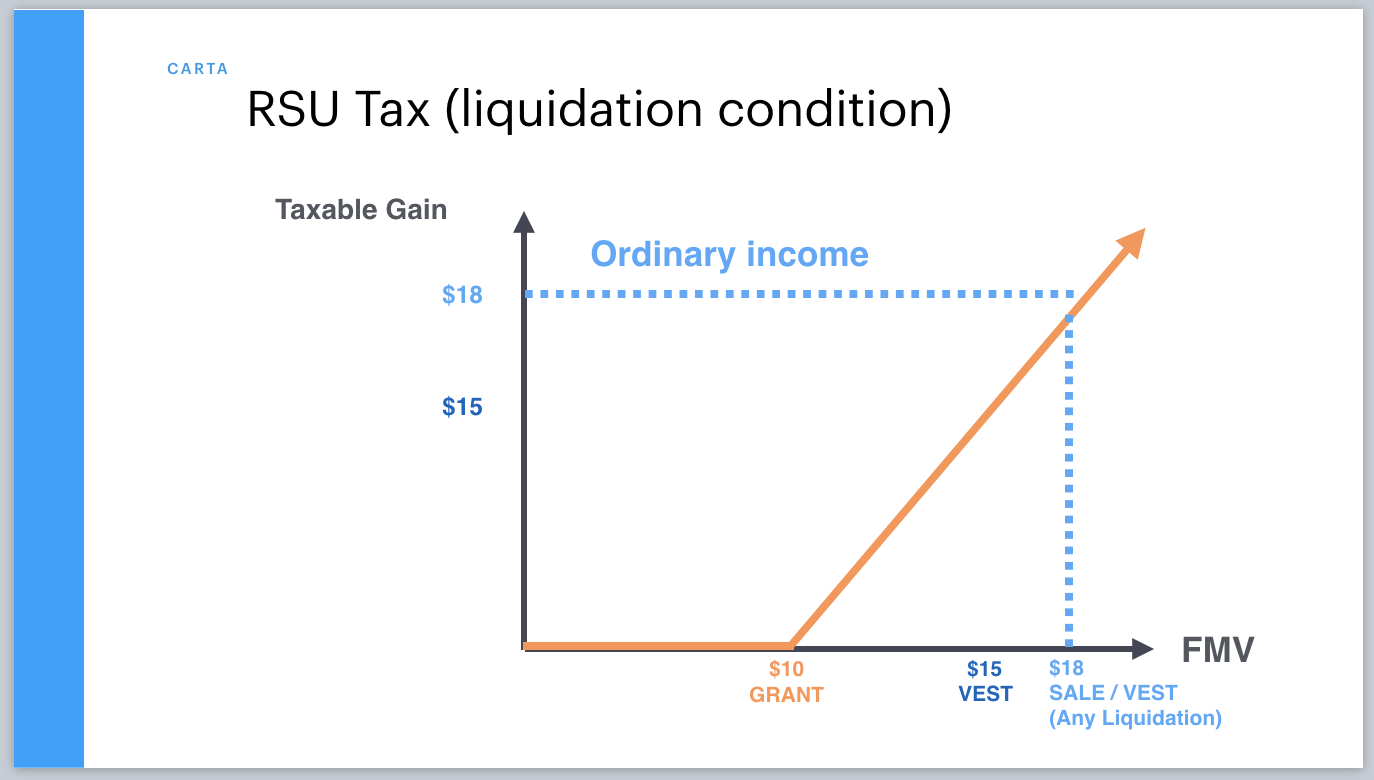

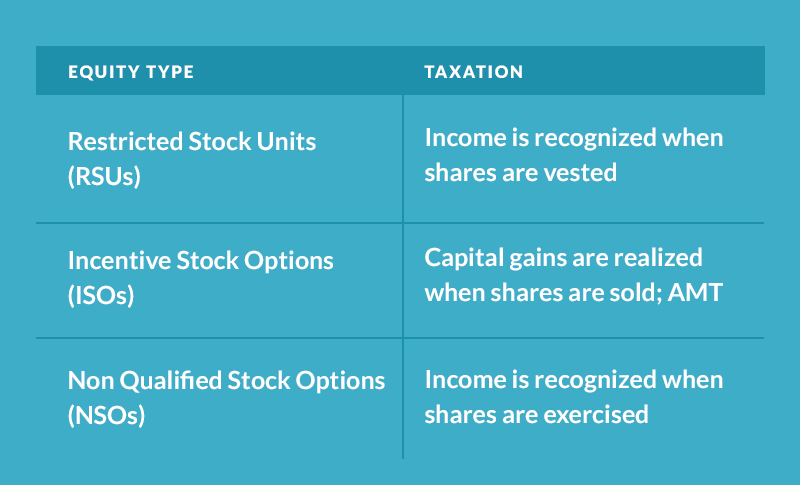

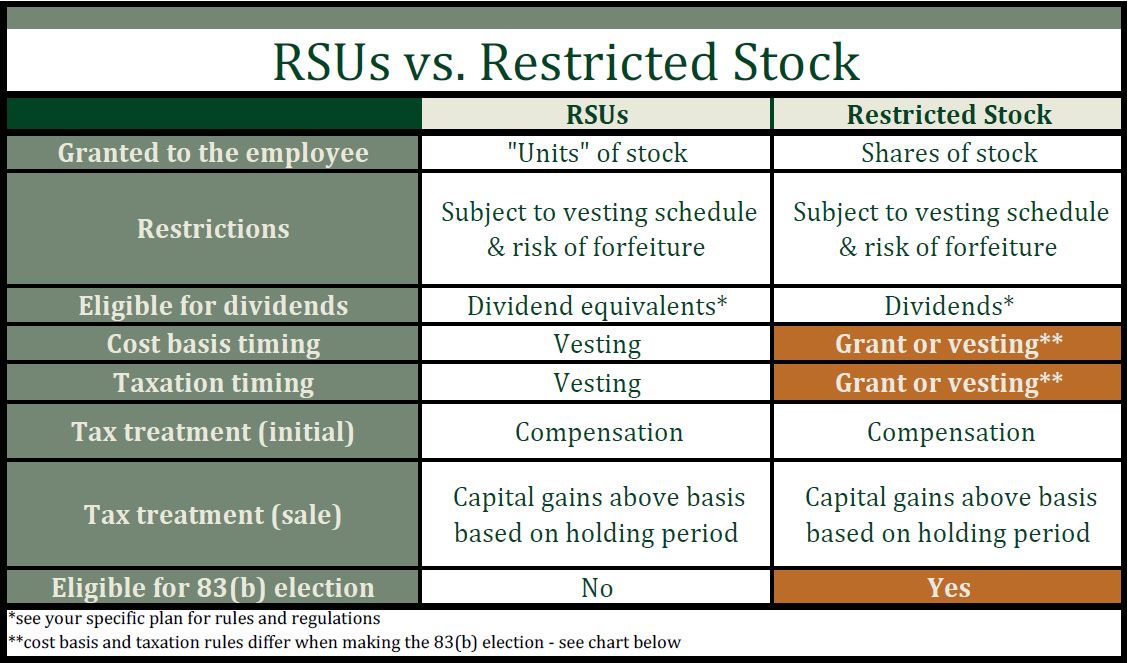

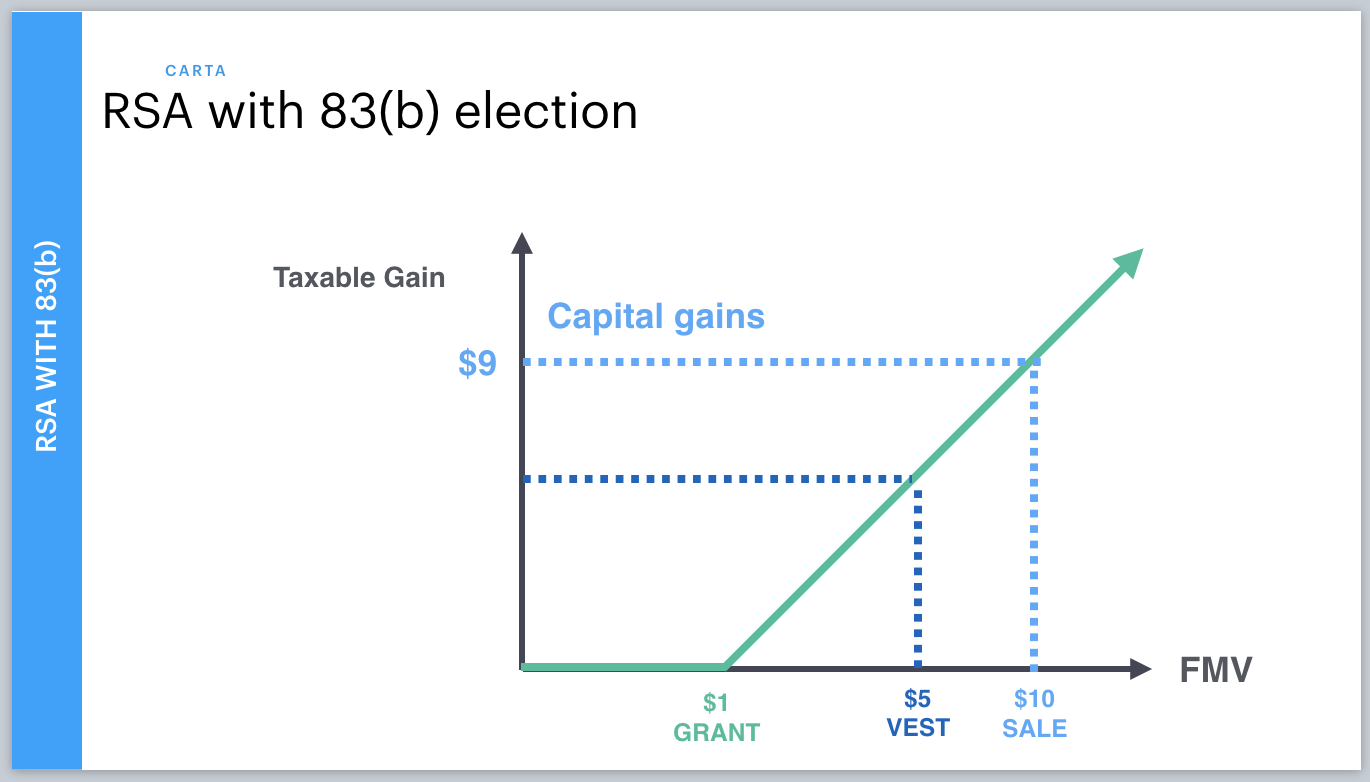

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

. Heres the tax summary for RSUs. Ad Compare Your 2022 Tax Bracket vs. The following hypothetical example outlines the entire life cycle of an RSU grant.

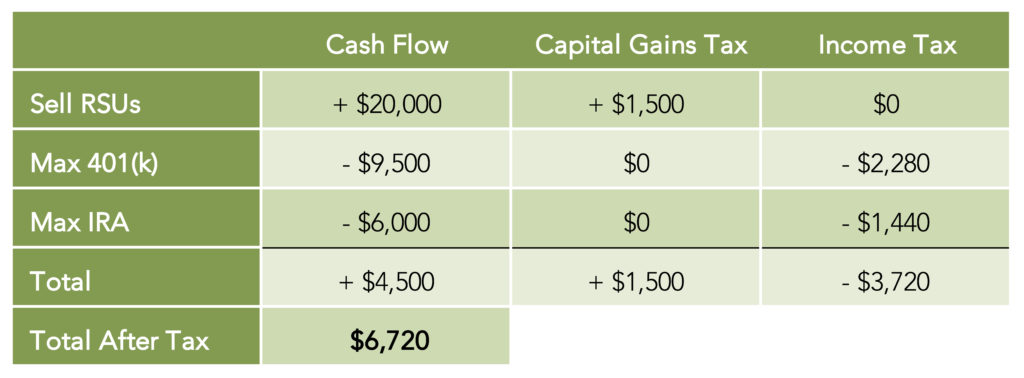

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. This happens over time through a vesting schedule. Op 23 days ago.

You receive 4000 RSUs that vest at a rate of. 23 days ago. Vesting after making over 137700.

To use the RSU projection calculator walk through the following steps. Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250. Long-term capital gains are taxed at a special lower rate.

Here is an article on employee stock options. How Are Restricted Stock Units RSUs Taxed. Check out our new Podcast EpisodeVideo.

Restricted stock is a stock typically given to an executive of a company. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale caution When you receive your shares you are taxed on.

As a CDN tax resindet you will always be taxed with CDN tax rates. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

And then immediately lost 12 ending up closing the first day of trading at 34. Some states have capital gains tax as well. For high earners the capital gains tax rate is anywhere from 188 to 238.

Its important to remember that the RSU tax rate will be the same as your income tax rates. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. Decide on your strategy.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. The loss from the sale of shares can be carried forward up to 5 years. If youre a single filer with 175000 taxable income youre at a 32 marginal tax rate.

A restricted stock unit RSU is a form of equity compensation used in stock compensation programs. You can use the 2020 brackets below to estimate your tax bracket Marginal State Tax Rate. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent.

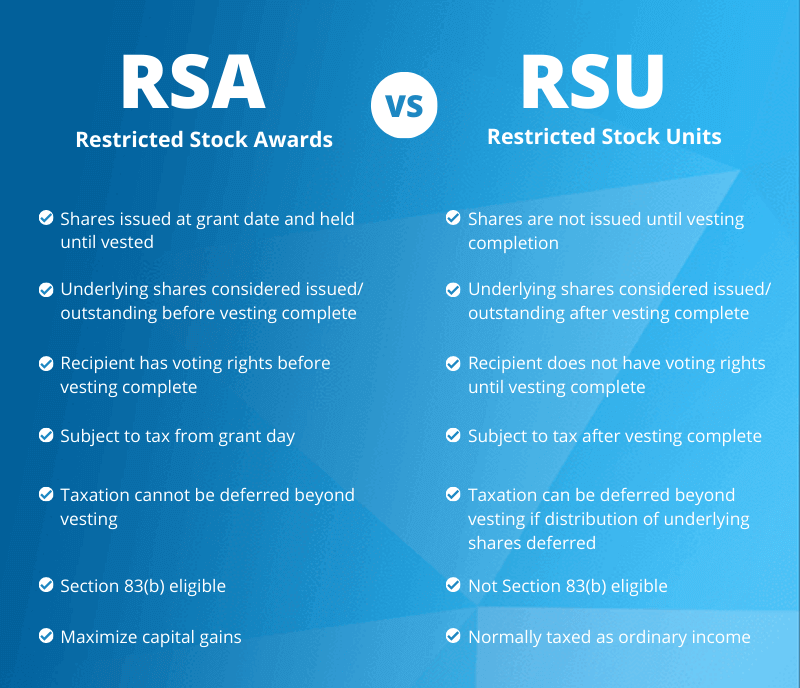

RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. Vesting after making over 200k single 250k jointly. An RSU is a grant valued in terms of company stock but company stock is not issued at the time of the grant.

Want more RSU info. De RSUs Restricted Stock Units. RSUs can also be subject to capital.

Ordinary tax on current share value. The beauty of RSUs is in the simplicity of the way they get taxed. Stock grants often carry restrictions as well.

For people working in California the total tax withholding on your RSUs are actually around 40. Enter the amount of your new grant - whether an offer grant or an annual refresh. Your 2021 Tax Bracket to See Whats Been Adjusted.

Discover Helpful Information and Resources on Taxes From AARP. Estimate how much your RSU value will increase per year. The RSUs you get will be taxed about half de to it being income and when you sell capital gains whether you sell form the US or Canada.

So its up to you to enter a percentage. For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift. For most people the tax rate on long-term capital gains is 15.

Vesting after Social Security max. A big note here you must enter a value even if the value is 0. The 22 doesnt include state income Social Security and Medicare tax withholding.

RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million.

In most circumstances the tax will be paid before you receive the shares ie. Vesting after Medicare Surtax max. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers.

Pay next years state income tax and. After the recipient of a unit satisfies the vesting requirement the company distributes shares or the cash equivalent of the number of. Long-term capital gains tax on gain if held for 1 year past vesting.

It is important for you to contact your tax advisor about the impact of these events on your taxes. The timing of RSU tax is exactly the same as any other. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 0 Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy.

Input your current marginal tax rate on vesting RSUs. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax. Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash.

The price could have fallen from the IPO list price. The stock is restricted because it is subject to certain conditions. An RSU is a grant valued in terms of company stock but company stock is not issued at the time of the grant.

For your state tax rate itd be a little much for us to pull each states income tax and include it. For academic purposes. Unlike the much more complicated ESPP they get taxed the same way as your income.

Example Of RSU Life Cycle. Robinhood just went IPO on July 28. As the name implies RSUs have rules as to when they can be sold.

In this case you sell them now. It too offered its employees the choice between 22 and 37 withholding on their RSUs vesting on Day 1. Robinhood listed at 38.

This is known as the 60 tax trap. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part. Step 4 - Edit State Tax Rate Assumption.

A app to help calculate how much tax you pay on RSUs A app to help calculate how much tax you pay on RSUs. 1 At the time of vesting and 2 At the time of sale.

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Why Rsus Can Make Tax Season Painful Schmidt

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Restricted Stock Units Jane Financial

Rsa Vs Rsu All You Need To Know Eqvista

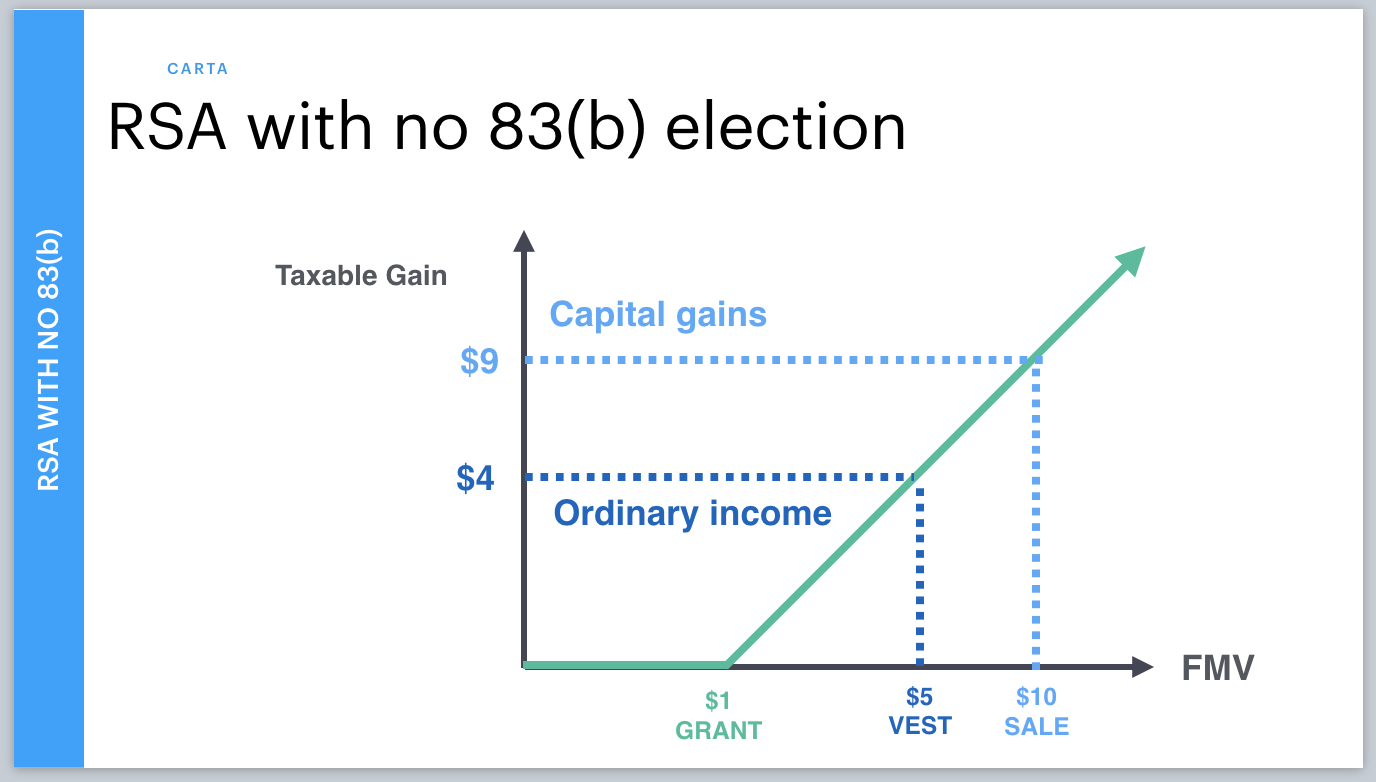

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta